This paper shows how problems in 'non-life'-(re)insurance can be modeled as cooperative games with stochastic payoffs. Pareto optimal allocations of the risks faced by the insurers and the insureds are determined. It is shown that the... more

In this paper we study the effect of network structure between agents and objects on measures for systemic risk. We model the influence of sharing large exogeneous losses to the financial or (re)insuance market by a bipartite graph. Using... more

We model the influence of sharing large exogeneous losses to the reinsurance market by a bipartite graph. Using Pareto-tailed claims and multivariate regular variation we obtain asymptotic results for the Value-at-Risk and the Conditional... more

We model business relationships exemplified for a (re)insurance market by a bipartite graph which determines the sharing of severe losses. Using Pareto-tailed claims and multivariate regular variation we obtain asymptotic results for the... more

risk in a large claims insurance market with bipartite

In earthquake and tsunami risk-prone regions such as Chile, catastrophe models help insurers and reinsurers understand and quantify the potential financial losses caused by these perils. The 2010 Maule earthquake highlighted the need for... more

In earthquake and tsunami risk-prone regions such as Chile, catastrophe models help insurers and reinsurers understand and quantify the potential financial losses caused by these perils. The 2010 Maule earthquake highlighted the need for... more

In earthquake and tsunami risk-prone regions such as Chile, catastrophe models help insurers and reinsurers understand and quantify the potential financial losses caused by these perils. The 2010 Maule earthquake highlighted the need for... more

William James (1919) characterises hypotheses as either live or dead. A hypothesis is live when it is taken into account as a 'real possibility'. We follow James' suggestion to not attribute intrinsic properties to hypotheses, but rather... more

Since the nineteenth century, sociologists have studied the relationship between economic business cycles and increases in crime. According to the U.S. Chamber of Commerce, crime may be a factor in as many as 30 percent of all business... more

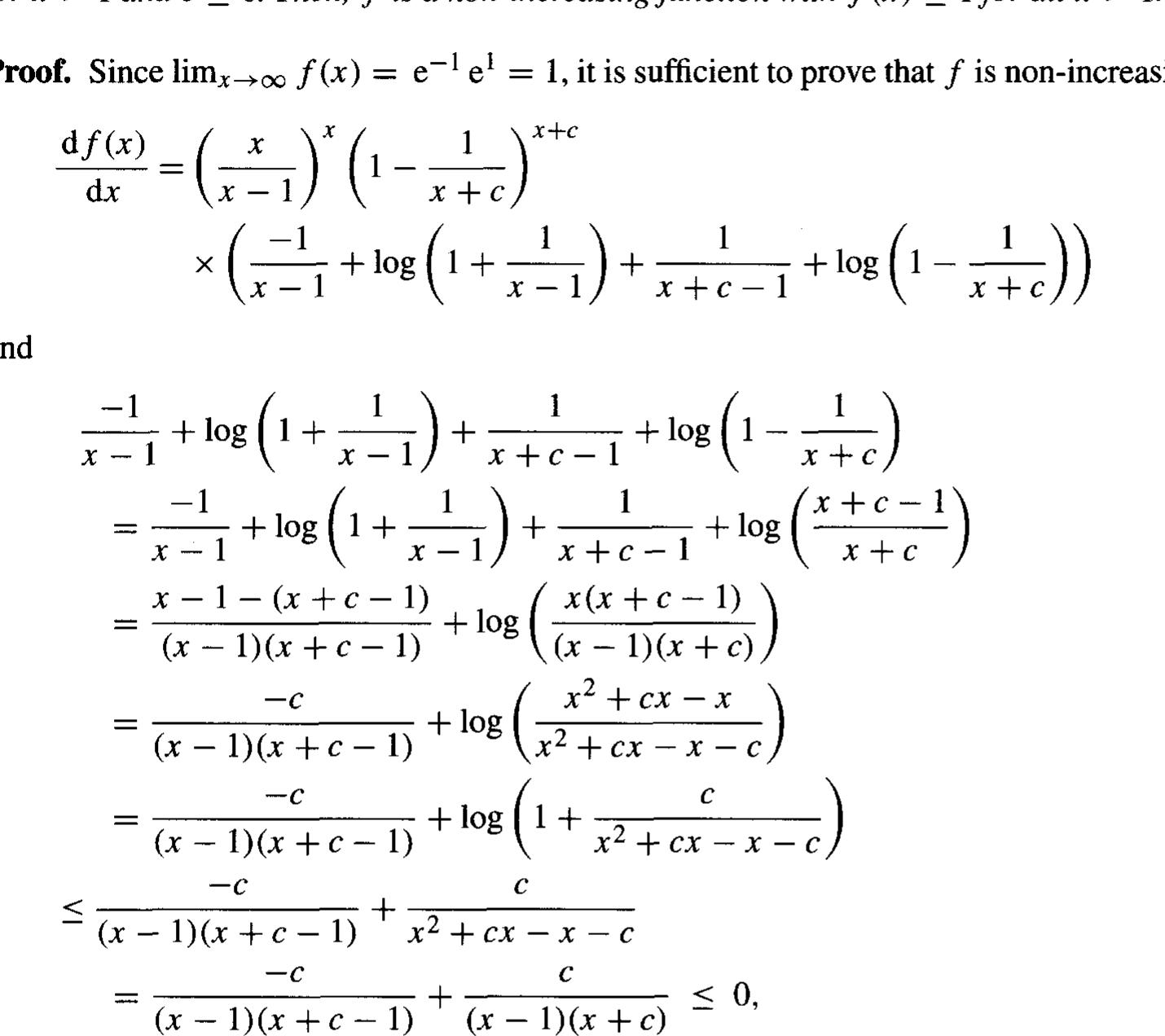

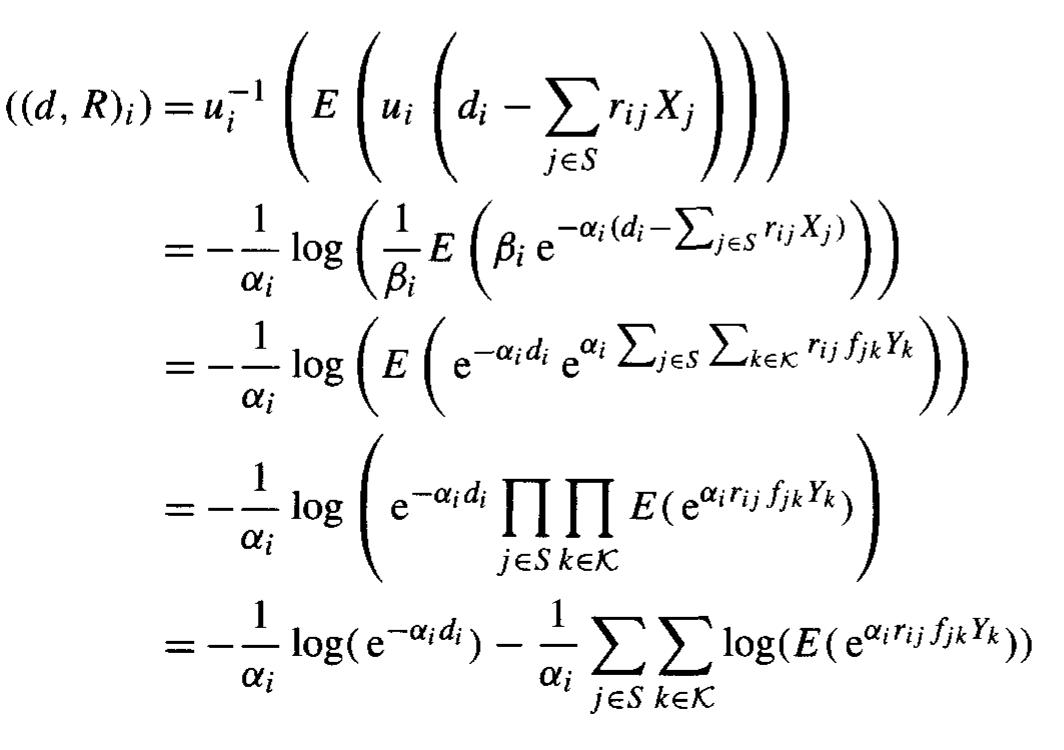

Shapley value is a popular way to compute payoffs in cooperative games where the agents are assumed to have deterministic, risk-neutral (linear) utilities.This paper explores a class of Multi-agent constantsum cooperative games where the... more

Since the nineteenth century, sociologists have studied the relationship between economic business cycles and increases in crime. According to the U.S. Chamber of Commerce, crime may be a factor in as many as 30 percent of all business... more

William James (1919) characterises hypotheses as either live or dead. A hypothesis is live when it is taken into account as a 'real possibility'. We follow James' suggestion to not attribute intrinsic properties to hypotheses, but rather... more

In this paper, we discuss how access to health-related data by private insurers, other than affecting the interests of prospective policy-holders, can also influence their propensity to make personal data available for research purposes.... more

Advances in genomics and postgenomics have renewed interest in the impact of genomic health information on private life insurance across Europe. These developments reopen the issue of how genes – apart from being the object of... more

An online business organization spends millions of dollars on firewalls, anti-virus, intrusion detection systems, digital signature, and encryption, to ensure minimal security breach. Nonetheless, a new virus or a clever hacker can easily... more

Security breaches deter e-commerce activities. Organizations spend millions of dollars on security appliances to make online transactions more secure. Nonetheless, a new virus or a clever hacker can easily compromise these deterrents and... more

We provide necessary and sufficient conditions for optimality of mutual contracts for risk sharing under constraints on premiums or utility functions of participants of the agreement. These conditions are an extension of those of the... more

This article addresses the reliance on genetic information as part of the private insurance industry’s practice of risk segmentation whereby underwritingdecisions are based on risk information about individuals and groups as compared to... more

We provide necessary and sufficient conditions for optimality of mutual contracts for risk sharing under constraints on premiums or utility functions of participants of the agreement. These conditions are an extension of those of the... more

We provide necessary and sufficient conditions for optimality of mutual contracts for risk sharing under constraints on premiums or utility functions of participants of the agreement. These conditions are an extension of those of the... more

Security breaches deter e-commerce activities.

This paper investigates a mixed regular-singular stochastic control problem where the drift of the dynamics is quadratic in the regular control variable. More importantly, the regular control variable is constrained. The value function of... more

We consider a model of a corporation, which can choose a production/business policy among an available set of control policies with different expected profits and associated risks. In addition, there is a choice of the amount of dividends... more

This paper shows how problems in 'non-life'-(re)insurance can be modeled as cooperative games with stochastic payoffs. Pareto optimal allocations of the risks faced by the insurers and the insureds are determined. It is shown that the... more

With the development and increasing accessibility of new genomic tools such as next-generation sequencing, genome-wide association studies, and genomic stratification models, the debate on genetic discrimination in the context of life... more

Public concern about genetic discrimination, particularly access to insurance following genetic testing, has been reported in the literature. This paper aims to separate myths from realities regarding genetic discrimination in life... more

Public concern about genetic discrimination, particularly access to insurance following genetic testing, has been reported in the literature. This paper aims to separate myths from realities regarding genetic discrimination in life... more

Abstract Public concern about genetic discrimination, particularly access to insurance following genetic testing, has been reported in the literature. This paper aims to separate myths from realities regarding genetic discrimination in... more

One of the most contentious topics in public policy debates on genetics has been the use of genetic information by private insurance companies. Confronted with legislation prohibiting the use of genetics in private insurance, the... more

This article offers an analysis of the way private insurers deal with the issue of genetics and insurance. Drawing on specific written insurance sources, a reconstruction is made of internal debates on genetics and insurance within the... more