U-CNNpred: A Universal CNN-based Predictor for Stock Markets

2019, arXive

Abstract

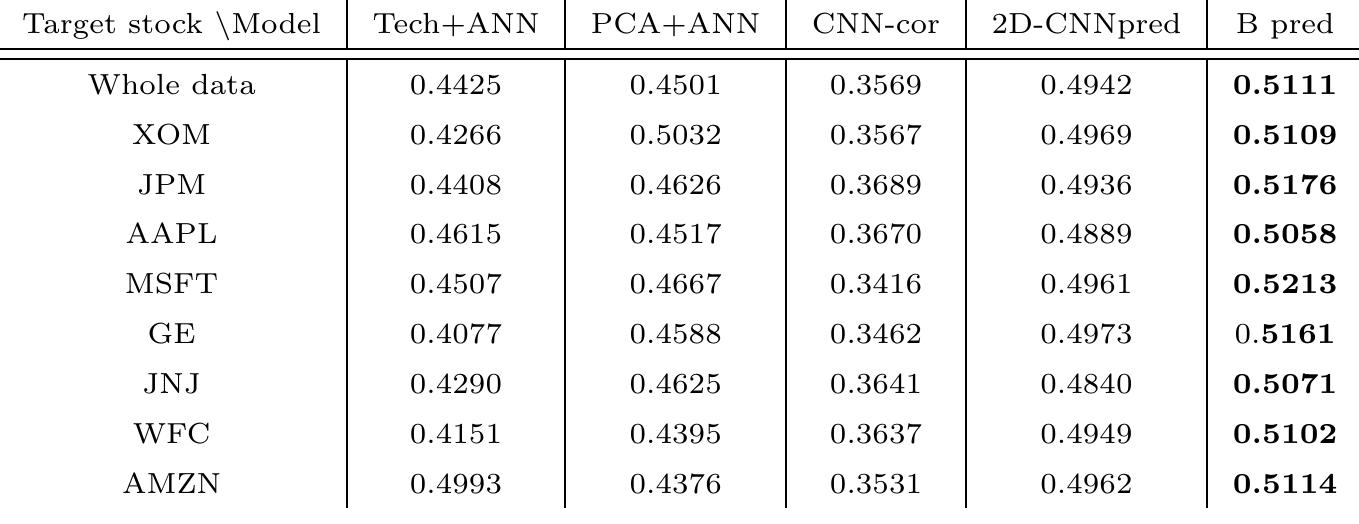

The performance of financial market prediction systems depends heavily on the quality of features it is using. While researchers have used various techniques for enhancing the stock specific features, less attention has been paid to extracting features that represent general mechanism of financial markets. In this paper, we investigate the importance of extracting such general features in stock market prediction domain and show how it can improve the performance of financial market prediction. We present a framework called U-CNNpred, that uses a CNN-based structure. A base model is trained in a specially designed layer-wise training procedure over a pool of historical data from many financial markets, in order to extract the common patterns from different markets. Our experiments, in which we have used hundreds of stocks in S\&P 500 as well as 14 famous indices around the world, show that this model can outperform baseline algorithms when predicting the directional movement of the markets for which it has been trained for. We also show that the base model can be fine-tuned for predicting new markets and achieve a better performance compared to the state of the art baseline algorithms that focus on constructing market-specific models from scratch.

References (71)

- Ahmadi, E., Jasemi, M., Monplaisir, L., Nabavi, M. A., Mahmoodi, A., & Jam, P. A. (2018). New efficient hybrid candlestick technical analysis model for stock mar- ket timing on the basis of the support vector machine and heuristic algorithms of imperialist competition and genetic. Expert Systems with Applications, 94 , 21-31.

- Arévalo, A., Niño, J., Hernández, G., & Sandoval, J. (2016). High-frequency trading strategy based on deep neural networks. In International conference on intelligent computing (pp. 424-436). Springer.

- Assis, C. A., Pereira, A. C., Carrano, E. G., Ramos, R., & Dias, W. (2018). Restricted boltzmann machines for the prediction of trends in financial time series. In 2018 International Joint Conference on Neural Networks (IJCNN) (pp. 1-8). IEEE.

- Atsalakis, G. S., & Valavanis, K. P. (2009). Surveying stock market forecasting techniques-part ii: Soft computing methods. Expert Systems with Applications, 36 , 5932-5941.

- Baek, Y., & Kim, H. Y. (2018). Modaugnet: A new forecasting framework for stock market index value with an overfitting prevention lstm module and a prediction lstm module. Expert Systems with Applications, 113 , 457-480.

- Balaji, A. J., Ram, D. H., & Nair, B. B. (2018). Applicability of deep learning models for stock price forecasting an empirical study on bankex data. Procedia computer science, 143 , 947-953.

- Ballings, M., Van den Poel, D., Hespeels, N., & Gryp, R. (2015). Evaluating multiple classifiers for stock price direction prediction. Expert Systems with Applications, 42 , 7046-7056.

- Bao, W., Yue, J., & Rao, Y. (2017). A deep learning framework for financial time series using stacked autoencoders and long-short term memory. PloS one, 12 , e0180944.

- Bengio, Y., Lamblin, P., Popovici, D., & Larochelle, H. (2007). Greedy layer-wise training of deep networks. In Advances in neural information processing systems (pp. 153-160).

- Bottou, L. (2010). Large-scale machine learning with stochastic gradient descent. In Proceedings of COMPSTAT'2010 (pp. 177-186). Springer.

- Cai, X., Hu, S., & Lin, X. (2012). Feature extraction using restricted boltzmann ma- chine for stock price prediction. In Computer Science and Automation Engineering (CSAE), 2012 IEEE International Conference on (pp. 80-83). IEEE volume 3.

- Chatzis, S. P., Siakoulis, V., Petropoulos, A., Stavroulakis, E., & Vlachogiannakis, N. (2018). Forecasting stock market crisis events using deep and statistical machine learning techniques. Expert Systems with Applications, 112 , 353-371.

- Chen, K., Zhou, Y., & Dai, F. (2015). A lstm-based method for stock returns pre- diction: A case study of china stock market. In Big Data (Big Data), 2015 IEEE International Conference on (pp. 2823-2824). IEEE.

- Chen, Y., & Hao, Y. (2017). A feature weighted support vector machine and k- nearest neighbor algorithm for stock market indices prediction. Expert Systems with Applications, 80 , 340-355.

- Chong, E., Han, C., & Park, F. C. (2017). Deep learning networks for stock market analysis and prediction: Methodology, data representations, and case studies. Expert Systems with Applications, 83 , 187-205.

- Chung, H., & Shin, K.-s. (2018). Genetic algorithm-optimized long short-term memory network for stock market prediction. Sustainability, 10 , 3765.

- Dai, W., Wu, J.-Y., & Lu, C.-J. (2012). Combining nonlinear independent component analysis and neural network for the prediction of asian stock market indexes. Expert systems with applications, 39 , 4444-4452.

- Di Persio, L., & Honchar, O. (2016). Artificial neural networks architectures for stock price prediction: Comparisons and applications. International Journal of Circuits, Systems and Signal Processing, 10 , 403-413.

- Ding, X., Zhang, Y., Liu, T., & Duan, J. (2015). Deep learning for event-driven stock prediction. In Ijcai (pp. 2327-2333).

- Duchi, J., Hazan, E., & Singer, Y. (2011). Adaptive subgradient methods for online learning and stochastic optimization. Journal of Machine Learning Research, 12 , 2121-2159.

- Enke, D., & Thawornwong, S. (2005). The use of data mining and neural networks for forecasting stock market returns. Expert Systems with applications, 29 , 927-940.

- Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. The journal of Finance, 25 , 383-417.

- Fischer, T., & Krauss, C. (2018). Deep learning with long short-term memory networks for financial market predictions. European Journal of Operational Research, 270 , 654-669.

- Gardner, M. W., & Dorling, S. (1998). Artificial neural networks (the multilayer perceptron)-a review of applications in the atmospheric sciences. Atmospheric environment, 32 , 2627-2636.

- Gunduz, H., Yaslan, Y., & Cataltepe, Z. (2017). Intraday prediction of borsa istan- bul using convolutional neural networks and feature correlations. Knowledge-Based Systems, 137 , 138-148.

- Guresen, E., Kayakutlu, G., & Daim, T. U. (2011). Using artificial neural network models in stock market index prediction. Expert Systems with Applications, 38 , 10389-10397.

- Hagan, M. T., & Menhaj, M. B. (1994). Training feedforward networks with the marquardt algorithm. IEEE transactions on Neural Networks, 5 , 989-993.

- He, K., Zhang, X., Ren, S., & Sun, J. (2016). Deep residual learning for image recognition. In Proceedings of the IEEE conference on computer vision and pattern recognition (pp. 770-778).

- Hecht-Nielsen, R. (1992). Theory of the backpropagation neural network. In Neural networks for perception (pp. 65-93). Elsevier.

- Hinton, G. E., Osindero, S., & Teh, Y.-W. (2006). A fast learning algorithm for deep belief nets. Neural computation, 18 , 1527-1554.

- Hoseinzade, E., & Haratizadeh, S. (2019). Cnnpred: Cnn-based stock market pre- diction using a diverse set of variables. Expert Systems with Applications, 129 , 273-285.

- Hsu, S.-H., Hsieh, J. P.-A., Chih, T.-C., & Hsu, K.-C. (2009). A two-stage architecture for stock price forecasting by integrating self-organizing map and support vector regression. Expert Systems with Applications, 36 , 7947-7951.

- Kara, Y., Boyacioglu, M. A., & Baykan, Ö. K. (2011). Predicting direction of stock price index movement using artificial neural networks and support vector machines: The sample of the istanbul stock exchange. Expert systems with Applications, 38 , 5311-5319.

- Khaidem, L., Saha, S., & Dey, S. R. (2016). Predicting the direction of stock market prices using random forest. arXiv preprint arXiv:1605.00003 , .

- Kia, A. N., Haratizadeh, S., & Shouraki, S. B. (2018). A hybrid supervised semi- supervised graph-based model to predict one-day ahead movement of global stock markets and commodity prices. Expert Systems with Applications, 105 , 159-173.

- Kim, H. Y., & Won, C. H. (2018). Forecasting the volatility of stock price index: A hybrid model integrating lstm with multiple garch-type models. Expert Systems with Applications, 103 , 25-37.

- Kim, K.-j., & Han, I. (2000). Genetic algorithms approach to feature discretization in artificial neural networks for the prediction of stock price index. Expert systems with Applications, 19 , 125-132.

- Kim, Y. (2014). Convolutional neural networks for sentence classification. arXiv preprint arXiv:1408.5882 , .

- Kingma, D. P., & Ba, J. (2014). Adam: A method for stochastic optimization. arXiv preprint arXiv:1412.6980 , .

- Krollner, B., Vanstone, B., & Finnie, G. (2010). Financial time series forecasting with machine learning techniques: A survey, .

- Lahmiri, S., & Bekiros, S. (2019). Cryptocurrency forecasting with deep learning chaotic neural networks. Chaos, Solitons & Fractals, 118 , 35-40.

- Larochelle, H., Bengio, Y., Louradour, J., & Lamblin, P. (2009). Exploring strategies for training deep neural networks. Journal of machine learning research, 10 , 1-40.

- LeCun, Y., Bengio, Y., & Hinton, G. (2015). Deep learning. nature, 521 , 436.

- LeCun, Y., Bengio, Y. et al. (1995). Convolutional networks for images, speech, and time series. The handbook of brain theory and neural networks, 3361 , 1995.

- Lohrmann, C., & Luukka, P. (2018). Classification of intraday s&p500 returns with a random forest. International Journal of Forecasting, .

- Moghaddam, A. H., Moghaddam, M. H., & Esfandyari, M. (2016). Stock market index prediction using artificial neural network. Journal of Economics, Finance and Administrative Science, 21 , 89-93.

- Nassirtoussi, A. K., Aghabozorgi, S., Wah, T. Y., & Ngo, D. C. L. (2014). Text mining for market prediction: A systematic review. Expert Systems with Applications, 41 , 7653-7670.

- Nelson, D. M., Pereira, A. C., & de Oliveira, R. A. (2017). Stock market's price movement prediction with lstm neural networks. In Neural Networks (IJCNN), 2017 International Joint Conference on (pp. 1419-1426). IEEE.

- Niño, J., Hernandez, G., Arévalo, A., Leon, D., & Sandoval, J. (2018). Cnn with limit order book data for stock price prediction. In Proceedings of the Future Technologies Conference (pp. 444-457). Springer.

- de Oliveira, F. A., Nobre, C. N., & Zárate, L. E. (2013). Applying artificial neural networks to prediction of stock price and improvement of the directional prediction index-case study of petr4, petrobras, brazil. Expert Systems with Applications, 40 , 7596-7606.

- Özgür, A., Özgür, L., & Güngör, T. (2005). Text categorization with class-based and corpus-based keyword selection. In International Symposium on Computer and Information Sciences (pp. 606-615). Springer.

- Pan, S. J., & Yang, Q. (2010). A survey on transfer learning. IEEE Transactions on knowledge and data engineering, 22 , 1345-1359.

- Patel, J., Shah, S., Thakkar, P., & Kotecha, K. (2015a). Predicting stock and stock price index movement using trend deterministic data preparation and machine learn- ing techniques. Expert Systems with Applications, 42 , 259-268.

- Patel, J., Shah, S., Thakkar, P., & Kotecha, K. (2015b). Predicting stock market index using fusion of machine learning techniques. Expert Systems with Applications, 42 , 2162-2172.

- Qiu, M., & Song, Y. (2016). Predicting the direction of stock market index movement using an optimized artificial neural network model. PloS one, 11 , e0155133.

- Qiu, M., Song, Y., & Akagi, F. (2016). Application of artificial neural network for the prediction of stock market returns: The case of the japanese stock market. Chaos, Solitons & Fractals, 85 , 1-7.

- Rather, A. M., Agarwal, A., & Sastry, V. (2015). Recurrent neural network and a hybrid model for prediction of stock returns. Expert Systems with Applications, 42 , 3234-3241.

- Robbins, H., & Monro, S. (1951). A stochastic approximation method. The annals of mathematical statistics, (pp. 400-407).

- Sagheer, A., & Kotb, M. (2019). Time series forecasting of petroleum production using deep lstm recurrent networks. Neurocomputing, 323 , 203-213.

- Sang, C., & Di Pierro, M. (2018). Improving trading technical analysis with tensorflow long short-term memory (lstm) neural network. The Journal of Finance and Data Science, .

- Sezer, O. B., & Ozbayoglu, A. M. (2018). Algorithmic financial trading with deep convolutional neural networks: Time series to image conversion approach. Applied Soft Computing, .

- Shen, G., Tan, Q., Zhang, H., Zeng, P., & Xu, J. (2018). Deep learning with gated re- current unit networks for financial sequence predictions. Procedia computer science, 131 , 895-903.

- Shin, H.-C., Roth, H. R., Gao, M., Lu, L., Xu, Z., Nogues, I., Yao, J., Mollura, D., & Summers, R. M. (2016). Deep convolutional neural networks for computer-aided detection: Cnn architectures, dataset characteristics and transfer learning. IEEE transactions on medical imaging, 35 , 1285-1298.

- Ticknor, J. L. (2013). A bayesian regularized artificial neural network for stock market forecasting. Expert Systems with Applications, 40 , 5501-5506.

- Tsantekidis, A., Passalis, N., Tefas, A., Kanniainen, J., Gabbouj, M., & Iosifidis, A. (2017). Forecasting stock prices from the limit order book using convolutional neural networks. In Business Informatics (CBI), 2017 IEEE 19th Conference on (pp. 7-12). IEEE volume 1.

- Vargas, M. R., de Lima, B. S., & Evsukoff, A. G. (2017). Deep learning for stock market prediction from financial news articles. In Computational Intelligence and Virtual Environments for Measurement Systems and Applications (CIVEMSA), 2017 IEEE International Conference on (pp. 60-65). IEEE.

- Yong, B. X., Rahim, M. R. A., & Abdullah, A. S. (2017). A stock market trading system using deep neural network. In Asian Simulation Conference (pp. 356-364). Springer.

- Zahedi, J., & Rounaghi, M. M. (2015). Application of artificial neural network models and principal component analysis method in predicting stock prices on tehran stock exchange. Physica A: Statistical Mechanics and its Applications, 438 , 178-187.

- Zeiler, M. D. (2012). Adadelta: an adaptive learning rate method. arXiv preprint arXiv:1212.5701 , .

- Zhong, X., & Enke, D. (2017a). A comprehensive cluster and classification mining procedure for daily stock market return forecasting. Neurocomputing, 267 , 152- 168.

- Zhong, X., & Enke, D. (2017b). Forecasting daily stock market return using dimen- sionality reduction. Expert Systems with Applications, 67 , 126-139.

Ehsan Hoseinzade

Ehsan Hoseinzade