Fin-Vest: Personal Finance Management

2022, IRJET

…

3 pages

1 file

Sign up for access to the world's latest research

Abstract

Managing money along with saving and investing is termed as personal finance. The financial plan details how to accomplish monetary goals whereas the budget helps to manage one's needs, wants, and investments. It includes reducing unnecessary expenses, increasing one's investments and planning for the future, etc. Information Technology has changed the world of management of income and finances by providing solutions to these vital problems of an individual by decreasing their expenses if it crosses its limits and providing suggestions which can help one to manage one's finances. In this project, we have built a personal finance management software using various python libraries. This software can be used by anyone who wants to track their expenses, income, and financial goals.

Key takeaways

AI

AI

- Fin-Vest offers comprehensive personal finance management for tracking income, expenses, and financial goals.

- The platform utilizes Python, MySql, and Tkinter to deliver a user-friendly interface and secure data storage.

- Users can optimize loan repayment strategies and visualize financial data through various graphs and tables.

- The budgeting feature applies the 50-30-20 rule, assessing users' financial status as Over-budget, Under-budget, or In-budget.

- Fin-Vest facilitates early retirement planning and provides educational resources on financial management.

Related papers

International Journal of Advanced Computer Science and Applications, 2021

Financial planning plays an important role in people's lives. The recent COVID-19 outbreak has caused sudden unemployment for many people across the globe, leaving them with a financial crisis. Recent surveys indicate that financial matters continue as the leading cause of stress for employees. Further, many millennials overspend and make unfortunate financial decisions due to their incapability to manage their earnings, which forbids them from maintaining financial satisfaction. Financial well-being as defined by The American Consumer Financial Protection Bureau (CFPB) is a state where one fully meets current and ongoing financial obligations, feels secure in their financial future, and is able to make choices to enjoy life. This work proposes a Personal Finance Management (PFM) system with a new architecture that aims to guide users to reach the state of financial well-being, as defined by CFPB. The proposed system consists of a rule-based system that provides users with actionable advice to make informed spending decisions and achieve their financial goals.

International Journal of Recent Technology and Engineering, 2020

The need for skilled financial advisors is more than ever in the current scenario when there are in-numerous moneymaking strategies and at the same time, the global economy might be on the verge of collapse. Also there is a pure lack of good financial advisors and even if you find one, you will end up paying a hefty amount. The current proposed application fulfils the above-stated demand in a cost-effective and reliable way. The proposed system automates the job of a financial advisor using Artificial Intelligence. It provides the user with a simple and easy to use interface where every individual will have their own account handled by Google’s firebase platform. The application uses 'Plaid' API which allows app to send a request to the corresponding bank server and fetch the account details of an individual. Logged in user is shown a very comprehensive representation of their account details which also includes category-wise expenditure, their investment, and the savings. O...

Online personal finance management system play important roles in managing finance at the personal level and of everyday use. There are different finance management systems on the world-wide web either in the form of open source or proprietary systems. But most of the systems are having specific context of usage and based on specific rules. In this work, we present reliable software architecture and corresponding system architecture of a system for personal financial planning on the web. Using through investigation and analysis, the application architecture is designed which is related to the business requirements, and the system architecture is related to information technology. The architecture is implemented using an open source web technology which uses an analysis model from the context of an industry model. The implemented system was tested and validated through feedback.

International Journal of Nature and Science Advance Research , 2025

Expense Analyzer is a mobile-based financial management system designed to help individuals and institutions monitor, categorize, and analyze their expenses efficiently. Financial mismanagement is a challenge faced by many due to the lack of real-time expense tracking tools. We adopted a structured software engineering methodology (SSADM) and implemented the system using React Native, Firebase, and Firestore to support Android and iOS platforms. The system allows users to log transactions, generate reports, receive budget alerts, and visualize spending patterns. Expense Analyzer simplifies personal and institutional budgeting, enabling better financial decisions, accountability, and organization.

2016

Many SMMEs fail within their first year of operation in South Africa mainly because of the lack of proper financial management skills. A number of attempts have been made by way of software applications; however, these attempts fail. This paper intends to design and implement a system that addresses some of the financial management challenges faced by SMMEs. To achieve this, features of similar systems were studies intensively through related work then incorporated into our system design and then implemented. The main objectives of the new system, was to make it possible for SMME owners to have access to their financial information anywhere, have access to real time data, reduce the amount of time needed to enter data in the system and a system that is easy to use. Usability testing was done and the result was a system that was 20% better in keeping records compared to the user’s manual accounting system.

International Conference on Research in Education and Science (ICRES) , 2023

This paper presents a mobile application aimed at enhancing the financial literacy of college students by monitoring their spending patterns and promoting better decision-making. The application is developed using the agile methodology with Android Studio and Flutter as development tools and Firebase as a database. The app is divided into sub-applications, with the home page serving as the program's integration point, displaying a summary of the user's financial progress. The app generates valuable insights into the user's current and future financial success, utilizing data analytics and machine learning to provide detailed and summary insights into the user's financial progress. The machine-learning algorithm used in this app is linear regression, which predicts the user's income and expenses for the upcoming month based on their historical spending data. In addition, the app highlights deals and student discounts in the user's vicinity and links to financial articles that promote better financial planning and decision-making. By promoting responsible spending habits and providing valuable financial insights, this mobile application aims to help students become financially literate and make informed financial decisions for future. [For the full proceedings, see ED654100.]

2020

The rapid development of information and communication technology is directly proportional to the community's need for fast and accurate information, especially the development of technology on mobile phones (cellphones) that present smartphones with various sophisticated features. Smartphones are becoming a necessity for society today not only as a communication device, but also as a source of information. In general, the community carries out daily financial management in the traditional way by taking notes using a writing instrument, where the paper media as its documentation and the help of a calculating tool is a calculator to calculate financial income and expenditure. Constraints that occur are that the public needs stationery to do every recording of transactions that are carried out every day. So it requires quite a lot of money, the time required will take a long time to record financial transactions that are carried out every day by the process of writing on paper med...

International Journal for Research in Applied Science & Engineering Technology (IJRASET), 2025

The growing financial complexity causes people to lose control over their financial expenses and savings goals together with their long-term planning requirements. Most personal finance management tools available today do not deliver forecasting statistics which match specific financial behavior patterns of their users. This paper unveils WealthGuardian which represents a smart expense management system which uses machine learning (ML) methodology to predict forthcoming expenses while improving budgetary restrictions and producing custom insurance policy suggestions. Support Vector Machines (SVM) and Random Forest operate together as robust ML algorithms to examine historical spending patterns and income behavior of users through the proposed system. Through model training these systems generate real-time expense forecasts which provide users an advanced financial perspective insight. The system merges data from external banks through APIs together with insurance plan databases to implement automated secure data transmissions which yield timely useful insights.

2021

The purpose of the article: the aim of the article is to present the essence of personal finance management using modern financial technologies. The paper seeks to answer the question of the impact financial literacy and the growth of the fintech solutions have on personal financial

Advanced IT Tools, 1996

Systems for financial planning exist. Many of these systems are, however, complex, expensive and designed for use by specialists. In the project described in this paper the aim was to investigate whether a knowledge-based system could be developed for "everyday" use by people engaged in financial planning. A system was developed, entitled the Retirement and Pension system (RAP), to deal with investment planning for people who could be eligible for an Age Pension. The system deals with simplified situations and generic investments. Trials with 91 members of the general public indicated that the system was regarded favourably and could be used successfully in problem solving. Investigation of problem solving behaviour with the system showed different patterns of behaviour-a considerable amount of "what-if' analysis, and some use ofthe explanation facility and help functions.

Fin-Vest: Personal Finance Management

Madhura Phadke 1, Divya Pondkule 2, Samidha Rane 3, Hrithika Sharan 4

1 Assistant Professor, Computer Engineering Department, Mumbai University, Datta Meghe College of Engineering, Navi Mumbai, Maharashtra, India

2 Student, Computer Engineering Department, Mumbai University, Datta Meghe College of Engineering, Navi Mumbai, Maharashtra, India

3 Student, Computer Engineering Department, Mumbai University, Datta Meghe College of Engineering, Navi

Mumbai, Maharashtra, India

4 Student, Computer Engineering Department, Mumbai University, Datta Meghe College of Engineering, Navi

Mumbai, Maharashtra, India

Abstract - Managing money along with saving and investing is termed as personal finance. The financial plan details how to accomplish monetary goals whereas the budget helps to manage one’s needs, wants, and investments. It includes reducing unnecessary expenses, increasing one’s investments and planning for the future, etc. Information Technology has changed the world of management of income and finances by providing solutions to these vital problems of an individual by decreasing their expenses if it crosses its limits and providing suggestions which can help one to manage one’s finances. In this project, we have built a personal finance management software using various python libraries. This software can be used by anyone who wants to track their expenses, income, and financial goals.

Key Words: Saving, investing, personal finance, financial plan, goals, budget, python.

1. INTRODUCTION

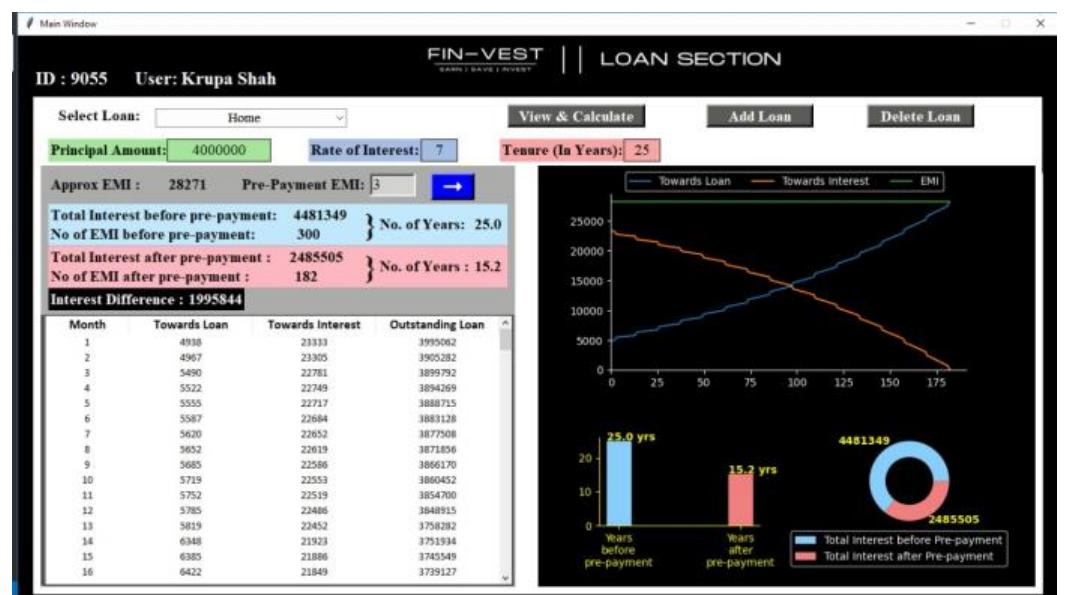

Fin-Vest is a platform that can be used to track personal income, expenses, and financial goals, identify spending patterns, saving patterns, plan short-term and long-term goals, and get a glimpse of finances with just a click of a button which will help user to take right decisions. In loan section, one can calculate original interest with respect to tenure, rate of interest, and plan to reduce tenure and interest amount of loan by pre-payment of EMI. One can compare original interest amount, tenure and optimized interest amount, tenure in the form of graphs.

In India, the normal age of retirement set by the government for most of the occupations is sixty years. But due to the current hectic life pattern, a new trend has made an entry which is early retirement planning. One can get an early retirement plan ready within no time and stay up to date with the current information of the constantly changing financial world using our platform.

1.1 Technologies Used

For developing this project, we have used the following technologies:

- Python as the main programming language.

- Matplotlib for visualization.

- Numpy for working with arrays.

- Pandas for data manipulation.

- MySql as a database for the project.

- Tkinter a python library to build GUI.

- Excel for raw calculations on data.

2. METHODOLOGY

Fin-Vest is a personal finance management platform that is mainly developed by using python, MySql, and Tkinter for GUI (graphical user interface). The platform has the following features such as input window for adding needs and wants, budgeting, loan section, short-term and longterm goals, early retirement plan, dashboard representing summary, and educational information.

First, the user needs to register in the Fin-Vest platform by entering the asked credentials. On registering the user gets a unique user id and all this data gets stored securely in the database. After registering user needs to log in using correct credentials which will be authenticated and if the credentials are correct then only the user logs in into the platform otherwise entry is denied. In the input window, the user has to enter the salary of the current month followed by needs and wants for that month.

If the user gets any bonus in the current month, then he/she needs to enter the bonus amount in the bonus section. If the user wants to make changes in the needs and wants section

then the user can use ADD, DELETE and UPDATE buttons present in their respective sections.

After entering the data in the input window, the user needs to go to the budgeting section where all entered data with summation of needs and wants amounts are shown in tabular format. The tabular format has been built using tree view widget from Tkinter GUI and data is fetched directly from the database into the tree view. According to the 50-3020 rule of budgeting the salary is divided and displayed to the user by using an algorithm that is developed in python coding language. After this, the respective function compares the total amount of needs and wants with the salary’s 50-3020 composition and displays status of the user whether the user is in Over-budget, Under-budget, and In-budget. On the right portion of the window, the graphical representation of budgeting is displayed for easy understanding. In lower section of the window annual summary of investment is represented in tabular format and besides it, there is an investment progress graph is displayed which is a line scatter plot.

In the loan section first, the user needs to enter the data of their loan. After that, calculations are displayed such as total payable interest on principal amount with its respective tenure. On the right-side pre-payment of EMI concept’s information is given for user understanding like how to reduce payable interest and tenure. After entering the number of EMIs to pre-pay, the pre-payment function gives optimized payable interest and reduced tenure along with comparison in tabular format. In the right section of window same comparison is displayed by using graphs consisting of line chart for overall comparison, bar plot for comparison of tenure, and donut graph for displaying the difference in before and after payable interest. By using the Loan section user can easily find out a strategy to optimize the loan.

In the planning window, user can plan their short-term and long-term goals along with retirement planning. In the beginning, user has to enter goals with their respective amount and no of years to achieve them. Likely user needs to enter the amount with which he/she wants to retire and in how many years. On the right-hand side goals, their amounts, time, and value at that time which is inflation calculated on that amount are displayed in tree view. On clicking the see planning button the user is directed to the next window which consists of a table having year-wise calculations of investment with total saved amount. On the right-hand side, the goals along with status whether it will be achievable or not in the given tenure is displayed. Adjustment options are also given at the bottom for goals.

Dashboard summarises all the user data using different graphs which are built using various data visualization python libraries. On the left-hand side of the dashboard, a salary with a 50-30-20 composition is displayed along with saving status. On the right-hand side user’s financial goals

information is displayed in a bar graph. In the center section needs and wants graphs are plotted which are horizontal bar graphs.

Here user data is completely secured and privacy is maintained. The user enters his/her own data so the integrity of data is maintained. This platform helps the user get answers to his/her financial questions like, is my spending pattern right, where/how do I spend and save, which months are financially bad or good, how to optimize loan, how to plan retirement, etc. So, this platform is all in one solution to all user’s financial queries.

Fig -1: Features of Fin-Vest

3. RESULTS

- Login and Registration window

- Input window

3. Budgeting window

4. Loan section

5. Early retirement and goals planning window

6. Dashboard

4. CONCLUSION

We have developed a software that evaluates financial condition of the user, helps to concentrate on monetary goals, organizes saving and spending, helps in building a better future and enables to invest wisely. It is important for everyone to have a personal finance plan in order to meet their financial goals, achieve financial stability, make rational financial decisions, take benefit of every financial opportunity and retire in comfort.

REFERENCES

[1] Rudolph, S., Savikhin, A., & Ebert, D. S. (2009). “FinVis: Applied visual analytics for personal financial planning”. 2009 IEEE Symposium on Visual Analytics Science and Technology. DOI: 10.1109/vast.2009.5333920

[2] Kanaujia, P. K. M., Pandey, M., & Rautaray, S. S. (2017). “Real time financial analysis using big data technologies”. 2017 International Conference on I-SMAC (IoT in Social, Mobile, Analytics and Cloud) (I-SMAC). DOI: 10.1109/I smac.2017.8058323

[3] Bi, Q., Tang, J., Van Fleet, B., Nelson, J., Beal, I., Ray, C., & Ossola, A. (2020). “Software Architecture for Machine Learning in Personal Financial Planning”. 2020 Intermountain Engineering, Technology and Computing (IETC). DOI: 10.1109/ietc47856.2020.9249171

References (10)

- Budgeting window

- Loan section

- Early retirement and goals planning window 6. Dashboard

- CONCLUSION REFERENCES

- Rudolph, S., Savikhin, A., & Ebert, D. S.

- "FinVis: Applied visual analytics for personal financial planning". 2009 IEEE Symposium on Visual Analytics Science and Technology. DOI: 10.1109/vast.2009.5333920

- Kanaujia, P. K. M., Pandey, M., & Rautaray, S. S.

- "Real time financial analysis using big data technologies". 2017 International Conference on I-SMAC (IoT in Social, Mobile, Analytics and Cloud) (I-SMAC). DOI: 10.1109/I smac.2017.8058323

- Bi, Q., Tang, J., Van Fleet, B., Nelson, J., Beal, I., Ray, C., & Ossola, A. (2020). "Software Architecture for Machine Learning in Personal Financial Planning". 2020

- Intermountain Engineering, Technology and Computing (IETC). DOI: 10.1109/ietc47856.2020.9249171

IRJET Journal

IRJET Journal