Exploring Trading Strategies and their Effects in the FX Market

2016

Abstract

One of the most critical issues that developers face in developing automatic systems or software agents for electronic markers is that of endowing the agents with appropriate trading strategies. In this paper, we examine the problem in the Foreign Exchange (FX) market and we use an agent-based FX market simulation to examine which trading strategies lead to market states in which the stylized facts (statistical properties) of the simulation match the stylised facts of the actual FX market transactions data. In particular, our goal is to explore the emergence of the stylized facts of the transactions data, when the simulated market is populated with agents using three different strategies: a variation of the zero-intelligence with a constraint (ZI-CV) strategy; the zero-intelligence directional-change event (ZI-DCT0) strategy; and a genetic programmingbased (GP) strategy. A series of experiments were conducted in an existing agent-based FX market with these three strategies and the r...

References (45)

- Alfi, V., M. Cristelli, L. Pietronero, and A. Zaccaria (2009), Minimal agent based model for financial markets I: origin and self-organization of stylized fatcs, The European Physical Journal B, 67(3), 385-397.

- Aloud, M., E. Tsang, R. Olsen, and A. Dupuis (2011), A directional-change events approach for studying financial time series, Economics Papers, No 2011-28.

- Aloud, M., M. Fasli, E. Tsang, A. Dupuis, and R. Olsen (2012), Modelling the high-frequency FX market: an agent-based approach, Tech. Rep. CES-519, University of Essex, United Kingdom.

- Alvim, L., and R. Milidi Ão (2013), Trading team composition for the intraday multistock market, Decision Support Systems, 54, 838-845.

- An, B., V. R. Lesser, and K. M. Sim (2011), Strategic agents for multi-resource negotiation, Autonomous Agents and Multi-Agent Systems, 23(1), 114-153.

- Arthur, W. (1991), Designing economic agents that act like human agents: a behavioral approach to bounded rationality, American Economic Review, 81, 353-359.

- Arthur, W. B., J. H. Holland, B. LeBaron, R. Palmer, and P. Tayler (1997), Asset pricing under endogenous expectations in an artificial stock market, in The economy as an evolving, complex system II, edited by W. Arthur, D. Lane, and S. Durlauf, pp. 15-44, Addison Wesley, Redwood City, CA.

- Becker, G. (1962), Irrational behaviour and economic theory, Journal of Political Economy, 70, 1-13.

- Chen, S.-H., and C.-H. Yeh (2001), Evolving traders and the business school with genetic programming: a new architecture of the agent-based artificial stock market, Journal of Economic Dynamics and Control, Elsevier, 25(3-4), 363-393.

- Cliff, D., and J. Bruten (1997a), More than zero intelligence needed for continuous double-auction trading, Tech. Rep. HPL-97-157, HP Laboratories Bristol.

- Cliff, D., and J. Bruten (1997b), Zero is not enough: On the lower limit of agent intelligence for continuous double auction markets, Tech. Rep. HPL-97-141, HP Technical Report.

- Dacorogna, M., R. Genï¿oeay, U. Mï¿oeller, R. Olsen, and O. Pictet (2001), An introduction to high-frequency finance, Academic Press, San Diego.

- Daniel, G. (2006), Asynchronous simulations of a limit order book, Ph.D. thesis, University of Manchester.

- Duffy, J., and M. Unver (2006), Asset price bubbles and crashes with near-zero-intelligence traders, Economic Theory, 27, 537-563.

- Farmer, J. (1998), Market force, ecology, and evolution, Industrial and Corporate Change, 11, 895-953.

- Fasli, M., and Y. Kovalchuk (2011), Learning approaches for developing successful seller strategies in dynamic supply chain management, Inf. Sci., 181(16), 3411-3426.

- Glattfelder, J., A. Dupuis, and R. Olsen (2011), Patterns in high-frequency FX data: discovery of 12 empirical scaling laws, Quantitative Finance, 11(4), 599-614.

- Gode, D., and S. Sunder (1993a), Allocative efficiency of markets with zero intelligence (Z1) traders: market as a partial substitute for individual rationality, Journal of Political Economy, 101(1), 119-137.

- Gode, D., and S. Sunder (1993b), Lower bounds for efficiency of surplus extraction in double auctions, in The Double Auction Market: Institutions, Theories, and Evidence. Santa Fe Institute Studies in the Sciences of Complexity, edited by D. Friedman and J. Rust, pp. 199-219, Perseus Publishing, Cambridge.

- Hommes, C. (2006), Heterogeneous agent models in economics and finance, in Handbook of Computational Economics, Handbook of Computational Economics, vol. 2, edited by L. Tesfatsion and K. L. Judd, chap. 23, pp. 1109-1186, Elsevier.

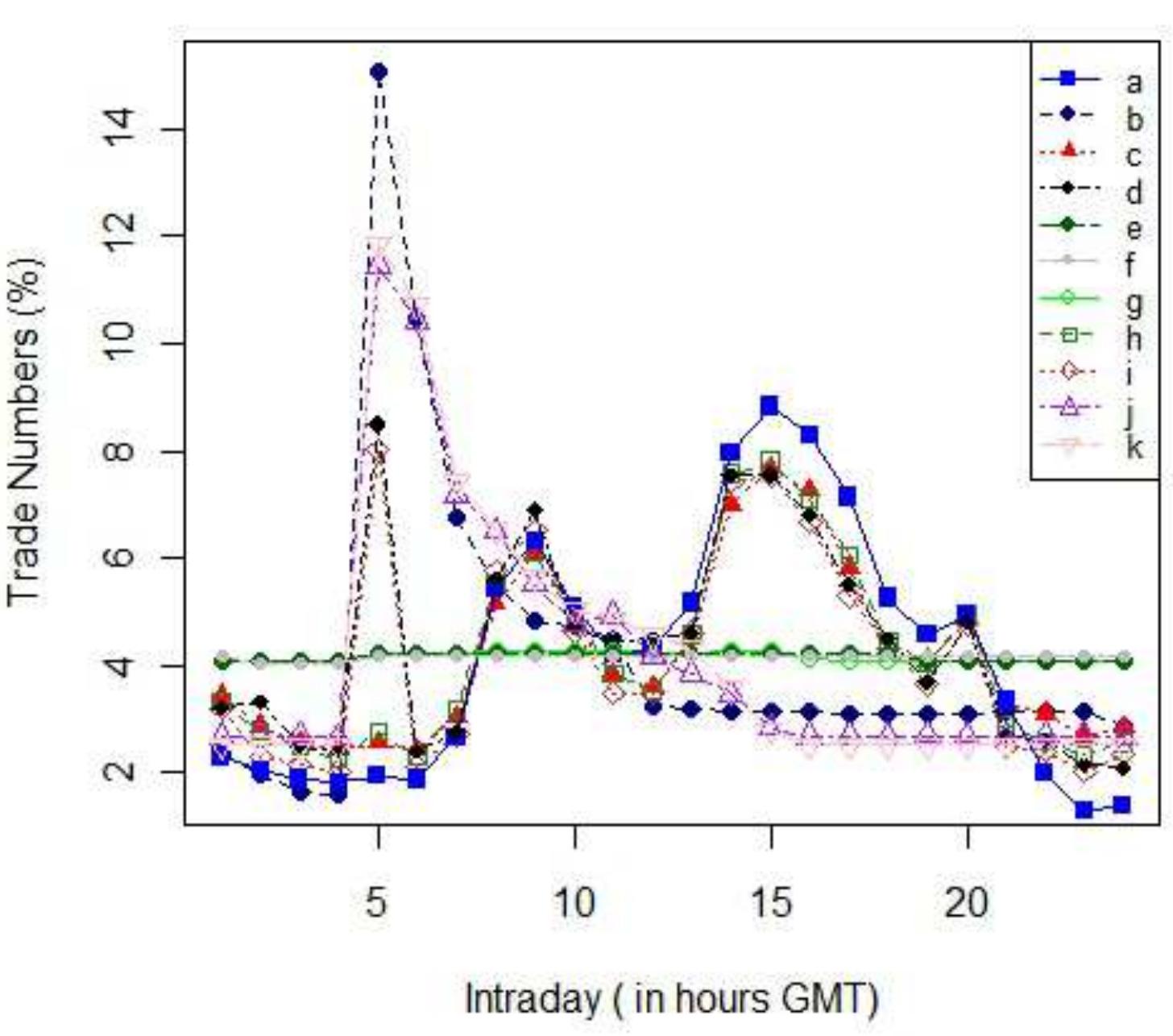

- Ito, T., and Y. Hashimoto (2006), Intraday seasonality in activities of the foreign exchange markets: Evidence from the electronic broking system, Journal of the Japanese and International Economies, Elsevier, 20, 637-664.

- Kettera, W., J. Collinsb, M. Ginib, A. Guptac, and P. Schraterb (2009), Detecting and forecasting economic regimes in multi-agent automated exchanges, Decision Support Systems, 47(4), 307-318.

- Ladley, D. (2010), Zero-intelligence in economics and finance, Knowledge Engineering Review: Special issue on Agent Based Computational Economics, 27, 273-286.

- LeBaron, B. (2001), A builder's guide to agent based financial markets, Quantitative Finance, 1 (2), 254-261.

- LeBaron, B. (2006), Agent-based computational finance, in Handbook of Computational Economics, vol. 2, edited by L. Tesfatsion and K. L. Judd, 1 ed., chap. 24, pp. 1187-1233, Elsevier.

- Li, J., and E. Tsang (2000), Reducing failures in investment recommendations using genetic programming, Computing in Economics and Finance 2000 332, Society for Computational Economics, Barcelona, Spain.

- LiCalzi, M., and P. Pellizzari (2003), Fundamentalists clashing over the book: a study of order-driven stock markets, Quantitative Finance, 3, 470-480.

- Martinez-Jaramillo, S., and E. Tsang (2009), An heterogeneous, endogenous and co-evolutionary GP-based financial market, IEEE Transactions on Evolutionary Computation, 13(1), 33-55.

- Niu, J., K. Cai, S. Parsons, P. McBurney, and E. Gerding (2010), What the 2007 tac market design game tells us about effective auction mechanisms, Journal of Autonomous Agents and Multiagent Systems, 21(2), 172-203.

- Niu, J., K. Cai, S. Parsons, M. Fasli, and X. Yao (2012), A grey-box approach to automated mechanism design, Electronic Commerce Research and Applications, 11(1), 24-35.

- Olsen, R. (2010), How to Trade, 1 ed., Think about Press, Olsen Ltd.

- Pierre, B. (1965), Pareto (vilfredo) -cours d'ï¿oeconomie politique, Revue ï¿oeconomique, Programme National Persï¿oee, 16 (5), 811-812.

- Rayner, N., S. Phelps, and N. Constantinou (2011), Learning is neither sufficient nor necessary: a dynamic agent-based model of long memory in financial markets, in Workshop on Robustness and Reliability of Elec- tronic Marketplaces.

- Ren, F., M. Zhang, and K. (2009), Adaptive conceding strategies for automated trading agents in dynamic, open markets, Decision Support Systems, 46(3), 704-716.

- Robinson, E., P. McBurney, and X. Yao (2012), Adaptive and Learning Agents, Lecture Notes in Computer Science, vol. 7113, chap. Co-learning segmentation in marketplaces, pp. 1-20, Springer Berlin Heidelberg, Berlin, Germany.

- Samanidou, E., E. Zschischang, D. Stauffer, and T. Lux (2007), Agent-based models of financial markets, Reports on Progress in Physics, 70, 409-450.

- Sanglier, M., M. Romain, and F. Flament (1994), A behavioral approach of the dynamics of financial markets, Decision Support Systems, 12(4-5), 405-413.

- Serguieva, A., F. Liu, and P. Date (2011), Financial contagion simulation through modelling behavioural char- acteristics of market participants and capturing cross-market linkages, in IEEE Symposium on Computational Intelligence for Financial Engineering & Economics, Paris, France.

- Sim, K. (2002), A market-driven model for designing negotiation agents, Computational Intelligence, Special issue in Agent Technology for E-commerce, 18(4), 618-637.

- Simon, H. (1982), Models of Bounded Rationality, MIT Press, Cambridge.

- Simon, H. (1995), A behavioral model of rational choice, The Quarterly Journal of Economics, 69, 99-118.

- Sunder, S. (2004), Market as an artifact aggregate efficiency from zero intelligence traders, in Models of a Man: Essays in memory of Herbert A. Simon, edited by M. Augier and J. March, pp. 501-519, MIT Press, Cambridge.

- Tsang, E. (2010), Directional changes, definitions, Tech. Rep. 050-10, Centre for Computational Finance and Economic Agents (CCFEA), University of Essex, UK.

- Tseng, J.-J., C.-H. Lin, C.-T. Lin, S.-C. Wang, and S.-P. Li (2010), Statistical properties of agent-based models in markets with continuous double auction mechanism, Physica A, 389, 1699-1707.

- Vytelingum, P. (2006), The structure and behaviour of the continuous double auction, Ph.D. thesis, University of Southampton.

Monira Aloud

Monira Aloud